How To Start A Credit Repair Business

Read our step-by-step guide below or get started with a free logo for a credit repair business!

Read our step-by-step guide below or get started with a free logo for a credit repair business!

Congratulations on taking the first steps toward starting your credit repair business! If you already have the passion for assisting clients in improving their credit histories and scores, and the skills such as credit analysis, dispute resolution and regulatory knowledge, but you’re unsure how to turn this into a business — we are here to help you every step of the way.

Starting a credit repair business allows you to assist individuals in managing and improving their financial standing through professional guidance and interventions. This business serves a crucial role in helping clients correct inaccuracies on their credit reports and improving their credit scores, which are vital for securing loans, housing, and sometimes employment. It’s a valuable service that can profoundly impact clients' financial opportunities and quality of life.

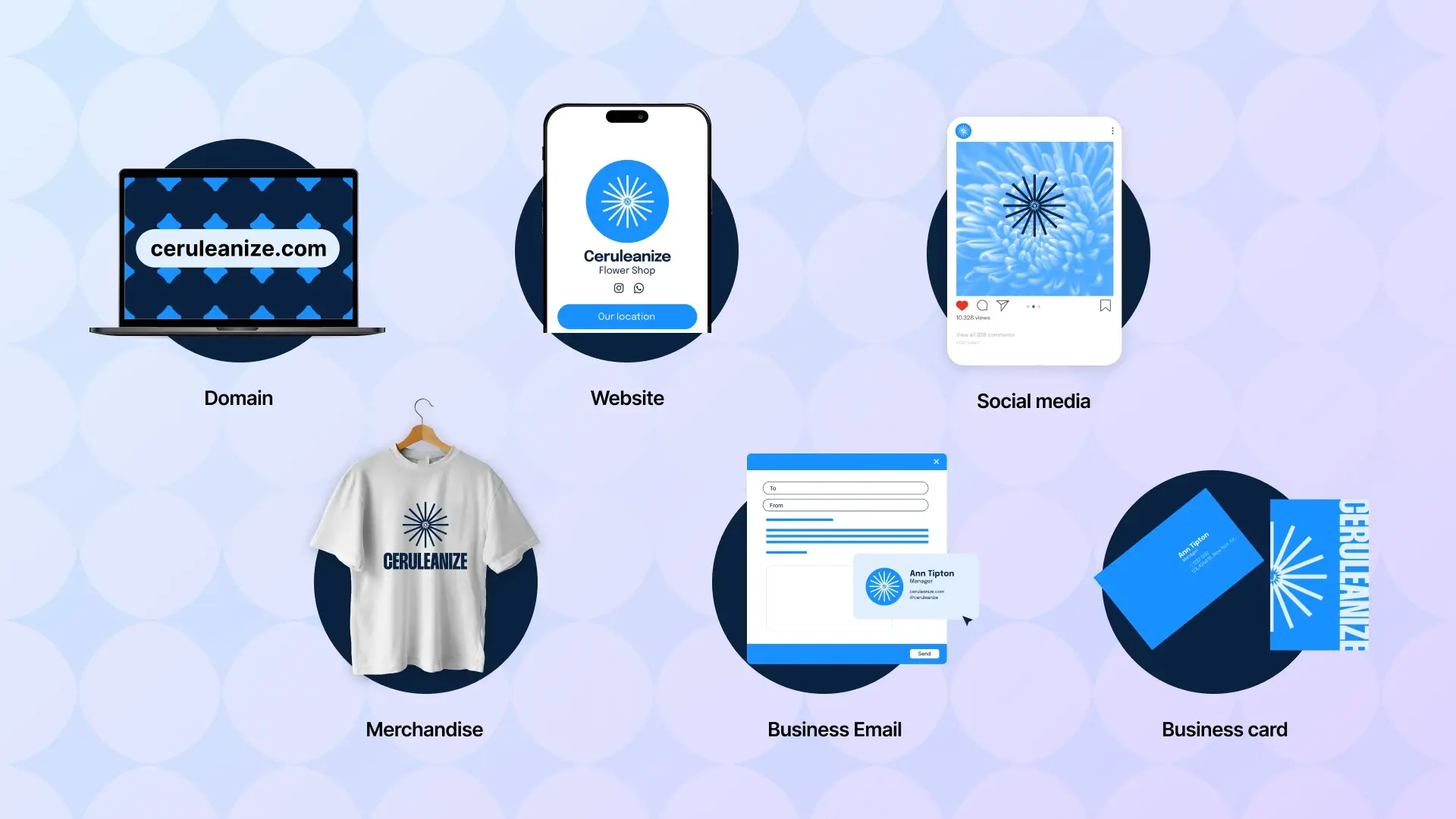

With our guide below, we will take you from the start by showing you how to give your finance business the perfect name and domain, all the way to success by launching it with a professional logo, website, business email and marketing material that is ready to attract customers who want improved and accurate credit scores, and therefore would be looking to your new credit repair business!

Haven’t figured out the perfect business name to showcase your skills in credit analysis yet? We’ve got you covered! With our business name generator, simply tell us more about your business and it will do all the hard work in coming up with great ideas for you to select from.

Some example prompts from our users include:

Choosing the right name for your business is more than just a task—it's about creating a meaningful connection with your customers who want improved and accurate credit scores. A great business name not only helps people remember you but also conveys who you are and what you offer in a memorable way. A memorable finance business name to start with will include: keeping it short and sweet, avoiding complex jargon, making it relevant and connecting it to your Industry.

For example, if you are starting a credit repair business, you may want to include your skills in assisting clients in improving their credit histories and scores in some way so it is clear to your potential customers what values, services and products you offer. You can also select a business type from our Business Name Generator and add a keyword such as credit repair specialist or regulatory knowledge so your perfect business name is as unique as you and your brand!

Once you have brainstormed the perfect business name, create a professional credit repair logo with our free logo maker! You can start by entering your business name below.

Starting a finance business can be hard without a high-quality logo, as this is what will represent you and your business. The right files are also needed to start and promote your service business across marketing channels once you have launched and are ready to find customers.

While it's possible to start a business assisting clients in improving their credit histories and scores by using free platforms such as social media, when you buy a domain name to own, you set yourself apart from your competitors.

By purchasing a domain name, you can create a professional image for your service business and make it easier for potential customers to find you online. Choosing the right domain name to start your credit repair business is like choosing the perfect outfit for a special occasion; it should reflect your style, make you stand out, and leave a lasting impression.

Like your finance business name, remember the golden rule when picking a domain: keep it simple and memorable. You want a name that people can easily recall and punch into their browsers without a second thought. Go for something short and snappy to dodge typos and avoid complicated spellings, unnecessary hyphens, or confusing numbers — they're just roadblocks for your visitors who want improved and accurate credit scores.

When starting a credit repair business in today's online world, having a website has become more of a necessity than a luxury. Whether you're an individual, a service business owner, or a large corporation, having an online presence is crucial for reaching out to your potential customers who are looking for businesses that can show their skills in credit analysis, dispute resolution and regulatory knowledge.

Building a professional website doesn’t have to be hard. With LOGO.com x Wix, you can be ready to go live in just a few minutes with all the features you need for any business including products, services, consultants, restaurants and much more . No tech skills required — get started for free below.

By signing up for a LOGO.com x Wix account, you have read and agree to the LOGO.com Terms and Conditions, the Wix Terms of Use, and you acknowledge the Wix Privacy Policy and the LOGO.com Privacy Policy. LOGO.com and Wix will share the information in your account with each other and also in accordance with their privacy policies.

Join relevant groups to credit repair on platforms like Facebook and LinkedIn and share your website within these communities. Ensure that you engage genuinely and share valuable comments that are not perceived as spam or overly promotional.

Owning and setting up your own business email (e.g. hello@cravecakes.com) rather than using a generic email domain (e.g. cravecakes@gmail.com) has a range of benefits.

Having a professional business email is key for all finance businesses looking to build credibility with their potential customers.

When you use a free or generic email service, your emails are often associated with a shared pool of users, some of whom may engage in spammy activities. This can lead to your emails being flagged as spam by email providers, which means the important information you’re trying to reach your customers with won’t reach them.

With your own domain, you have greater control over your email environment. This makes it less likely for your messages to be mistakenly classified as spam and increases the likelihood of your customers who want improved and accurate credit scores in opening up and reading what you have to share.

Recipients are more likely to open and engage with emails sent from a recognizable and legitimate domain than from generic or unfamiliar addresses. As more sophisticated scams have become more common in recent years, customers are more attentive to spammy and malicious emails.

By reducing the number of emails that go into your spam filters and building more trust with your customers, you can ultimately increase your credit repair business's communication and sales!

Congratulations on getting this far! Now that you have a professional business name, domain, website and business email, it’s time to promote your new credit repair business to find customers both online and offline.

By understanding the type of people who would want improved and accurate credit scores, this will help you prioritize the type of marketing to start with.

Customers of a credit repair business are individuals who have experienced credit issues, including inaccuracies, unfair reporting, or identity theft, which may hinder their financial abilities. These clients are often looking for expert advice and services to navigate the complex process of credit restoration effectively. They value confidentiality, expertise, and effective results that can open up new financial possibilities.

By understanding the type of people who would want improved and accurate credit scores, this will help you prioritize the type of marketing to start with.

Online marketing, or digital marketing, is promoting products/services on the internet. Marketing materials you may need to promote your service business include:

It's about reaching your audience where they are online and highlighting your offering in credit analysis, dispute resolution and regulatory knowledge to drive sales and engagement. As a starting point, below are some helpful articles on getting your Social Media assets created with Stitch, our all-in-one design tool.

Building Your Business With Templates - Introduction to Stitch

When it comes to connecting with your audience, you have powerful tools at your fingertips. Platforms like Facebook, Instagram, and LinkedIn aren't just for scrolling; they're bridges to your customers who want improved and accurate credit scores. With every post and ad, you can shout out your business, engage your followers, and direct them to your website to learn more.

Starting a credit repair business can be highly rewarding as it provides a service that can have a significant positive impact on clients' lives. However, it requires a deep understanding of credit laws, a strong commitment to ethical practices, and the ability to manage sensitive client information securely. While the business can offer substantial returns, it also demands ongoing education and adaptation to changing regulations and financial practices to remain effective and compliant.

I have the required skills, equipment or knowledge to turn this into a business.

I have brainstormed the perfect business name.

I have created a professional and unique logo that represents my business and brand.

I have registered a memorable domain name that relates to my business name.

I have built a website that includes my logo, my products or service and business values.

I have set up a professional business email address to communicate with customers.

I have created marketing materials that I can use to promote my business, such as across social media, emails, networking events and merchandise.

Starting a finance business is an exciting journey that can leave you feeling both overwhelmed or overjoyed on the same day. Fortunately, with careful planning and execution, you can lay a sturdy foundation for your service business. The next step is to continue marketing your business and working on building strong customer relationships. You can find more resources on LOGO.com about growing your business.

Remember, with passion, perseverance in assisting clients in improving their credit histories and scores, and hard work, you can take your credit repair business from start to success!